Gold and Silver Price Trends: A Global 30-Day Analysis and What Experts Expect Next

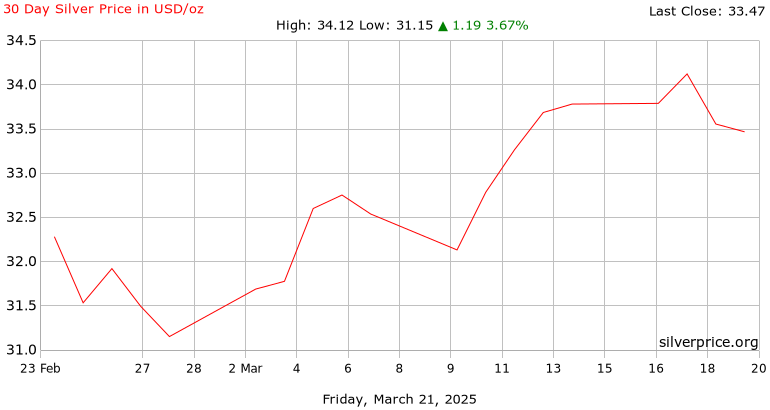

Over the past 30 days, gold and silver price trends have experienced sharp ups and downs across global markets, drawing attention from investors, traders, and economists alike. While gold maintained relative stability, silver showed aggressive rallies followed by fast corrections — highlighting the difference between safe-haven demand and speculative momentum.

This article breaks down:

- Global gold and silver price movements over the last 30 days

- Key price peaks and corrections

- What researchers and market analysts expect next

- Whether the current trend is temporary or part of a larger cycle

📊 Gold and Silver Peaks – Last 30 Days (Global View)

(These charts reflect international spot prices and highlight recent volatility.)

🟡 Gold Price Movement: Stability with Gradual Strength

What happened globally?

- Gold showed a gradual upward bias during the month

- Several price peaks formed mid-month, followed by controlled pullbacks

- Despite volatility in global markets, gold held key support levels

Why gold stayed strong

According to research shared by the World Gold Council, gold continues to benefit from:

- Central bank accumulation

- Persistent inflation concerns

- Global geopolitical uncertainty

- Demand for currency hedging

Gold’s behavior suggests institutional confidence, even when short-term traders take profits.

⚪ Silver Price Movement: High Volatility, Higher Opportunity

📈 Understanding Recent Gold and Silver Price Trends

What happened in the silver market?

Gold showed relatively stable movement with controlled pullbacks, while silver behaved more aggressively.

- Silver experienced rapid price surges, followed by sharp declines

- Strong rallies pushed prices to short-term peaks

- Corrections were faster and deeper than gold

Why silver moves differently

Silver sits at the intersection of:

- Precious metals investment

- Industrial demand (solar panels, electronics, EVs)

- Speculative trading

Analysts from Silver Institute note that silver historically:

“Outperforms gold during bullish cycles but underperforms during corrections.”

This explains why silver appears more dramatic on charts.

🔍 A Clear Pattern Seen by Analysts

Across global exchanges, a repeating pattern appeared:

| Phase | Market Behavior |

|---|---|

| Early period | Slow accumulation |

| Mid-period | Strong upside momentum |

| Peak | Profit-taking and resistance |

| Late period | Correction or consolidation |

This behavior reflects short-term positioning by funds, not a breakdown in long-term fundamentals.

For a deeper explanation of what’s driving the broader rally, you can also read our detailed guide here:

👉 Why Gold and Silver Prices Are Rising

📉 Why Corrections Don’t Mean the Trend Is Over

Market researchers emphasize an important point:

Corrections are healthy in rising markets.

According to analysts at Goldman Sachs, short-term pullbacks:

- Remove excess speculation

- Reset momentum indicators

- Create stronger foundations for the next move

Both gold and silver recently showed higher lows, a classic sign of trend continuation rather than reversal.

🔮 What Researchers Expect in the Near Future

Gold outlook

- Expected to remain stable to moderately bullish

- Supported by central bank demand and global uncertainty

- Less volatile, more defensive

Silver outlook

- Expected to remain volatile

- Higher upside potential than gold

- Sensitive to economic data and industrial demand forecasts

Economists from International Monetary Fund have also highlighted that:

- Inflation persistence and currency risks continue to favor hard assets

- Precious metals remain relevant in diversified portfolios

💡 What This Means for Global Investors

- Gold suits investors seeking stability and long-term protection

- Silver suits investors comfortable with volatility and timing

- Sudden dips should be evaluated in context, not emotionally

Long-term trends matter more than daily price swings.

📌 Final Thoughts

The past 30 days showed that:

- Gold continues to act as a global financial anchor

- Silver remains a high-potential but high-risk asset

- Volatility does not equal weakness

As global economic uncertainty persists, both metals remain structurally important, with silver offering opportunity and gold offering security.